We have merged with another of the world’s leading issuer-processors, Paymentology, to form a new force in payments, united under the Paymentology name.

We now offer even more power, more reach, more possibility, and more ways for banks and fintechs to rapidly issue cards and new products, anywhere in the world, at scale.

Tutuka is now

Paymentology

Pro The next level for banks and ambitious fintechs

Extreme flexibility, data-richness, and scalability, with true global reach. The leading in-Cloud solution for digital banks and high-performing fintechs.

Trusted by industry leaders, game-changers, and their proven apps.

More power. More data. More possibilities

Create and rapidly deploy finely tuned payment products, with the most sophisticated Platform and the richest data.

PayRule Decision Engine

PayRule Decision Engine’s unrivalled flexibility gives you the ultra-granular product-control to do business on your exact terms.

Rich, real-time data

We provide more than 120 lines of rapid, meaningful, layered data; actionable even at POS-level.

Credit and tokenisation

Offer leading card products and services; including credit, tokenisation, physical and digital cards, and more.

Offer today’s leading card products

Issue highly tailored virtual and physical card products, easily and at scale, anywhere in the world.

Issue digital Visa or Mastercard debit cards, with full control over how they are used, and the option to issue physical cards too.

Issue funds to customers, employees and other recipients safely and easily, with preloaded cards that are fully secure and easy to use.

Push tokens to all leading Pay wallets. With cardholder token control, and sensitive details never exposed, tokenisation is the next evolution in security.

The next evolution in privacy; combining app-based customer card-control, and physical cards displaying no sensitive cardholder details.

We process across multiple regions, in any currency. Now, you can offer and deliver multi-currency products and value-adds, easily and rapidly.

Issue digital Visa or Mastercard debit cards, with full control over how they are used, and the option to issue physical cards too.

Issue funds to customers, employees and other recipients safely and easily, with preloaded cards that are fully secure and easy to use.

Push tokens to all leading Pay wallets. With cardholder token control, and sensitive details never exposed, tokenisation is the next evolution in security.

The next evolution in privacy; combining app-based customer card-control, and physical cards displaying no sensitive cardholder details.

We process across multiple regions, in any currency. Now, you can offer and deliver multi-currency products and value-adds, easily and rapidly.

Credit

Issue, manage and control credit products, at scale. Design, innovate and deploy products and services, with unprecedented configurability and agility.

Enable all the capabilities associated with “traditional” revolving credit, at the highest possible level, with design and deployment made simple.

Trigger post-purchase offers to convert a portion of a credit balance into instalments, when customers are eligible, according to your rules.

Offer a range of Buy Now Pay Later (BNPL) products, giving you more business opportunities, and your customers more options.

Ultra-flexible combo cards, allowing customers to switch between the functionality of both credit and debit card products.

We offer Shari’ah Compliant, Murabaha credit products, to enable inclusive and culturally fit financial services.

Enable all the capabilities associated with “traditional” revolving credit, at the highest possible level, with design and deployment made simple.

Trigger post-purchase offers to convert a portion of a credit balance into instalments, when customers are eligible, according to your rules.

Offer a range of Buy Now Pay Later (BNPL) products, giving you more business opportunities, and your customers more options.

Ultra-flexible combo cards, allowing customers to switch between the functionality of both credit and debit card products.

We offer Shari’ah Compliant, Murabaha credit products, to enable inclusive and culturally fit financial services.

Richer data. Deeper insights

Paymentology FAST Message provides over 120 transaction details, in a rich, layered, easily interpretable, real-time feed. Not only more data than our competitors, but smarter, faster, and more actionable, too.

FAST is Paymentology’s “Framework for Authorisation and Settlement Transmission” interface. It empowers meaningful participation in the authorisation message; providing enriched, full-scheme messaging with enhanced spend-analytics.

Active participation

A real-time feed to the bank, with the bank making the authorisation decision.

Passive participation

A real-time feed to bank, after Paymentology has made the authorisation decision.

Choose your format

Elect to receive the authorisation message in JSON or XML formats.

FAST setup assistance

Paymentology works alongside clients, assisting with FAST setup, and sharing expertise in the authorisation process.

Decision Engine

PayRule Engine is our proprietary AI-powered Decision Engine, with unrivalled flexibility. It empowers our customers to set and control rules at almost any level; including card, customer, merchant, segment, category, and many others.

Set fraud rules to allow dynamic assessment of fraud-scenarios, in real-time.

Configure and customise rules at an ultra-granular level, with PayRule Engine.

Cloud-native scalability

With everything in the Cloud, nothing needs to be taken offline or disrupted to create or fine-tune programmes, or increase transaction capacity as you scale.

Shared Cloud

The cost-effective, fast-to-market, frictionless solution.

Our Cloud capabilities are highly scalable. Always ready to rapidly expand, as you grow.

We don't just comply with best practices. We set the benchmark.

We achieve virtually no downtime, with our ultra-smart active/active clustering solution.

Integrate into all major Cloud systems, including AWS, Google Cloud, Oracle, Microsoft Azure, and more.

Private Cloud is available exclusively with our Enterprise product. If needed, we're able to establish a dedicated instance for you, with full functionality.

Rapid time-to-market

We have extensive experience integrating into numerous traditional and modern core banking systems, including Mambu, Thought Machine, 10x Banking, and more.

Frictionless integration and migration.

We ensure rapid, seamless, low-friction integration and migration, thanks to our extensive experience, benchmark-setting best practices, and ultra-flexible APIs.

We understand banks. We’ve migrated tens of millions of cards for our clients. We have successfully migrated our clients from platforms like Wirecard, FIS and GPS.

Create cards instantly with the most powerful, most secure APIs

Superior capability.Powerful APIs

Our APIs are more sophisticated, more secure, more flexible, and more comprehensive, out of the box.

{

client_id: 760131,

user_id: 760131,

remarks: “Creating card For Customer“,

input_type: “t“,

input_id: 520872406

api_call_unique_identifier: 438574845790657485,

}

Test products in minutes

Decrease second-line fraud disputes

Protect data with Maker and 2FA

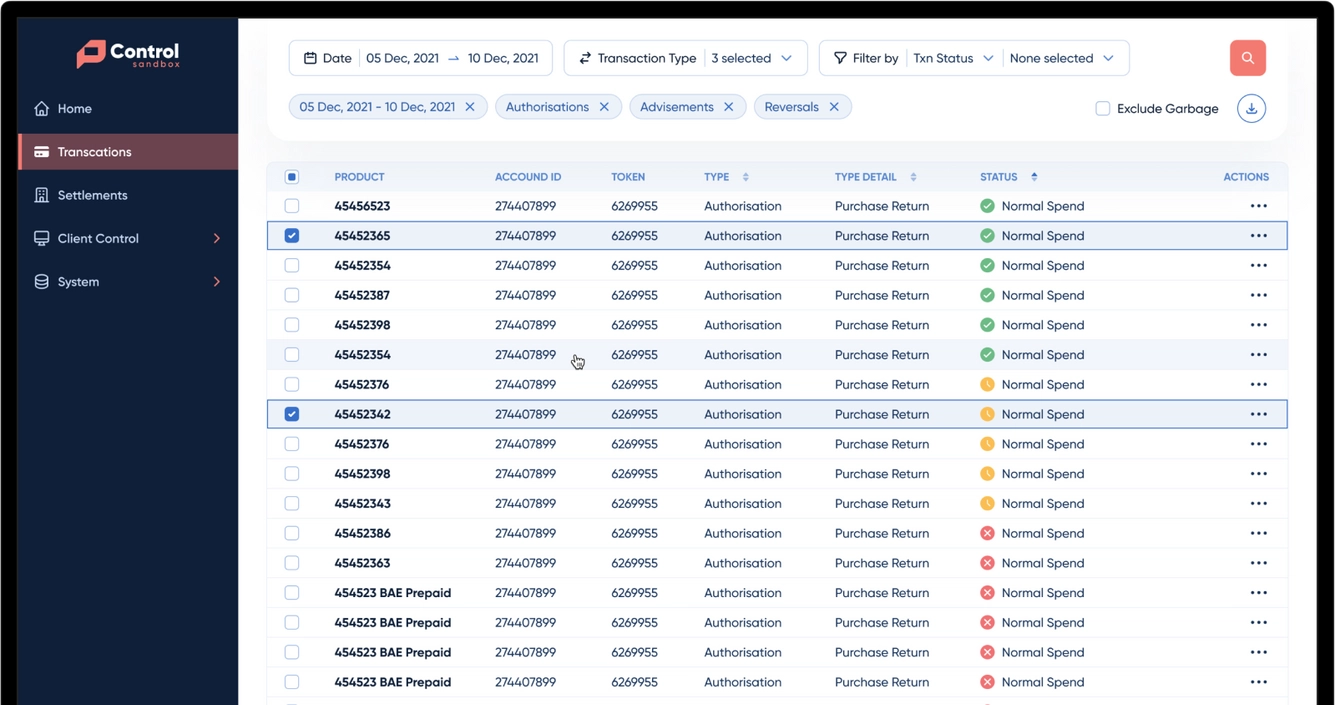

You decide.PayControl

Your portal to control rules, issue cards and manage your own programmes.

Detailed system logs

Optimise back-office expenses

Easily understandable data

Other great built-in features

A wide variety of products

Offer travel cards, commercial cards, single cards linked to multiple accounts, multiple cards linked to single accounts, loyalty and rewards, and numerous credit products.

Deploy into any Cloud

We can deploy programmes into any major Cloud scheme that suits your needs, smoothly and fast.

Low-latency

With geo-strategic processing, we offer consistent, high transaction speeds and uptime, wherever you’re based.

Dispute management

We're on hand to provide support in the event of disputes, including chargeback claims and more.

Reliable reporting

We provide all the data you need to manage reconciliation and optimise your programme.

3DS

Approve legitimate transactions through native mobile integration, to minimise e-commerce fraud.

User privacy

Our systems are fully compliant with General Data Protection Regulation (GDPR) guidelines, as well as all Mastercard and Visa standards.

Compliance made simple

We’re PCI DSS Level-1 compliant, meaning we take care of all the certification “heavy-lifting” for you.

After-sales service

We partner for the longterm. From launch phase, through exponential growth, to fulfilment of your vision and beyond, we're by your side, all the way.

24/7 global support

With expert Paymentologists and support Teams on the ground, all around the world, we’re on hand, at all times.

Contact us

Our payment experts are on hand to guide you, answer your questions, and get you up and running, fast.

Pro: commonly asked questions

Still not sure if Pro is the right fit for you?

Programme management and card-issuing, made easy.

Modern card solutions for fintechs, with easy integration.

Industry-leading solutions for banks and ambitious fintechs.

The ultimate solution, tailored for banks at the forefront.

Available

UK, EU, South Africa

Worldwide

excluding on-soil countries

Worldwide

including Saudi Arabia on-soil

Worldwide

no restrictions

Processing

Start innovating your payments with us

Speak to a payments expert in your region and we'll get you informed, up, and running, quickly and easily.